Assets

Assets are the personal items you own that can be distributed to your beneficiaries after your death. They include items owned exclusively by you, such as your house, car, cash, savings, jewellery, books, photos, business, shares, and investments. It may also include assets from your superannuation fund, assets owned by discretionary or unit trusts, proceeds from your life insurance policy, and assets held in family companies or trusts.28 Your assets are collectively known as your ‘estate’.

Beneficiaries

Your beneficiaries are the people you chose to receive your assets after you die. This may include your latest or former husband or wife, your latest de-facto partner, your children or grandchildren, and someone with whom you were living in a close personal relationship with at the time of your death.29

Challenging a will

A will can be challenged on the basis of undue influence (you didn’t act voluntarily with true intentions while making the will and coercion was involved) or fraud (a material fact was intentionally misrepresented in the will). These challenges must be validated.10

Codicil

An amendment to the will on a separate document. The codicil should be in writing, signed and witnessed by two people, and may require professional advice.9

Contesting a will

A will can be contested by people who feel that they haven’t been fairly treated in the will. For example they could be a family member who’s been left out of your will and believe they’re entitled to a portion of your estate, or a loved one who thinks they should’ve received more from your estate.11

Creditors

A bank, supplier, or person that you owe money to. If you die and haven’t paid back the money owed, they can make a claim on your estate as repayment.30

Death Certificate

A document issued and signed by a doctor or the registrar of births and deaths stating the cause, date, and place of your death.31

Estate

Your estate includes all the property, possessions, and money you own. This includes real estate, cars, cash, pensions, personal belongings, shares, superannuation, and life insurance. Your debts are also part of your estate.32

Estate planning

Estate planning is the preparation of tasks that serve to manage all of your assets and financial affairs in the event of your incapacitation or death. This includes the distribution of your assets to your beneficiaries, the settlement of estate taxes, making a will, naming a guardian for your children under 18, appointing a successor trustee for a family trust, providing for the transfer of your business and personal dealings, and setting up an enduring power of attorney.23

Executor

The person or organisation you nominated in your will who’ll be responsible for administering your estate after you die, once they obtain a ‘Grant of Probate’ from the Supreme Court of the state in which you reside. You can nominate a lawyer, family member, friend, or a will service employee to be your executor.6

Grant of Probate

A Grant of Probate is a legal document given to an executor when the Supreme Court of the state in which you reside approves their probate application. It confirms that the will-maker has died, the will is valid, and the executor is who they say they are. It essentially authorises your executor to manage your estate in accordance with your will.33

International will

An international will is a will made overseas if the will-maker owns assets in another country. It’s recognised as a valid will in countries that are party to the Convention Providing a Uniform Law on the Form of an International Will 1973. This includes Australia.8

Last will and testament

Your last will and testament is the latest legal document you executed before your death. It essentially cancels out any will and testament you’ve made before. It’s final unless someone decides to challenge or contest it.4

Lawyer

A lawyer may be the person you choose to prepare your will, be nominated as your executor, or be appointed as your enduring power of attorney.

Power of attorney

A power of attorney is a legal document giving another person the authority to deal with your property and financial affairs on your behalf. For example, they can pay your bills, sell your house, and look after your affairs while you’re travelling or ill. When choosing between a general power of attorney and an enduring power of attorney, it’s best to choose the latter as they can continue to manage your property and financial affairs when you lose the capacity to make your own decisions. You can appoint a lawyer, family member, friend, or a will service to act as your attorney.27

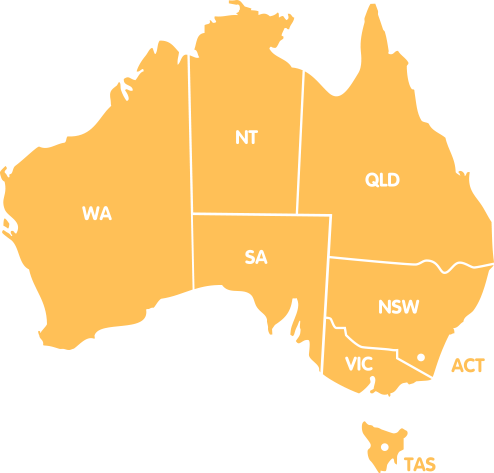

Probate

Probate is the process in which your executor has to prove and register your last will and testament in the Supreme Court of the state in which you reside in order to get the authority to administer your estate and handle the disposal of your assets and debts. This process varies according to each state and territories practice.15

Resealing a Grant of Probate

If you also have assets in other states of Australia, your executor can apply to the Supreme Courts in those states to reseal the original grant. Once a reseal has been granted, your executor can also deal with the assets under your will that aren’t located in the state where the original grant was achieved.34

Valid will

For a will to be valid, it should be in writing (handwritten, typed or printed), written by a person who’s over 18 years of age and mentally competent, properly drawn up and clearly sets out the will-maker’s wishes), and signed in the presence of two adult witnesses who also sign the will and aren’t beneficiaries.5

Will

A will is a legal document that outlines what you’d like to happen to your assets after your death. You can choose beneficiaries to whom your assets will be distributed and nominate an executor who’ll administer your estate after you die.2

DID YOU KNOW?

Many seniors believe that social legacy is more enduring (84.2%) and more

important (81.7%) than leaving a financial legacy.1