The Australian Seniors Series: The Quality of Life Report 2022

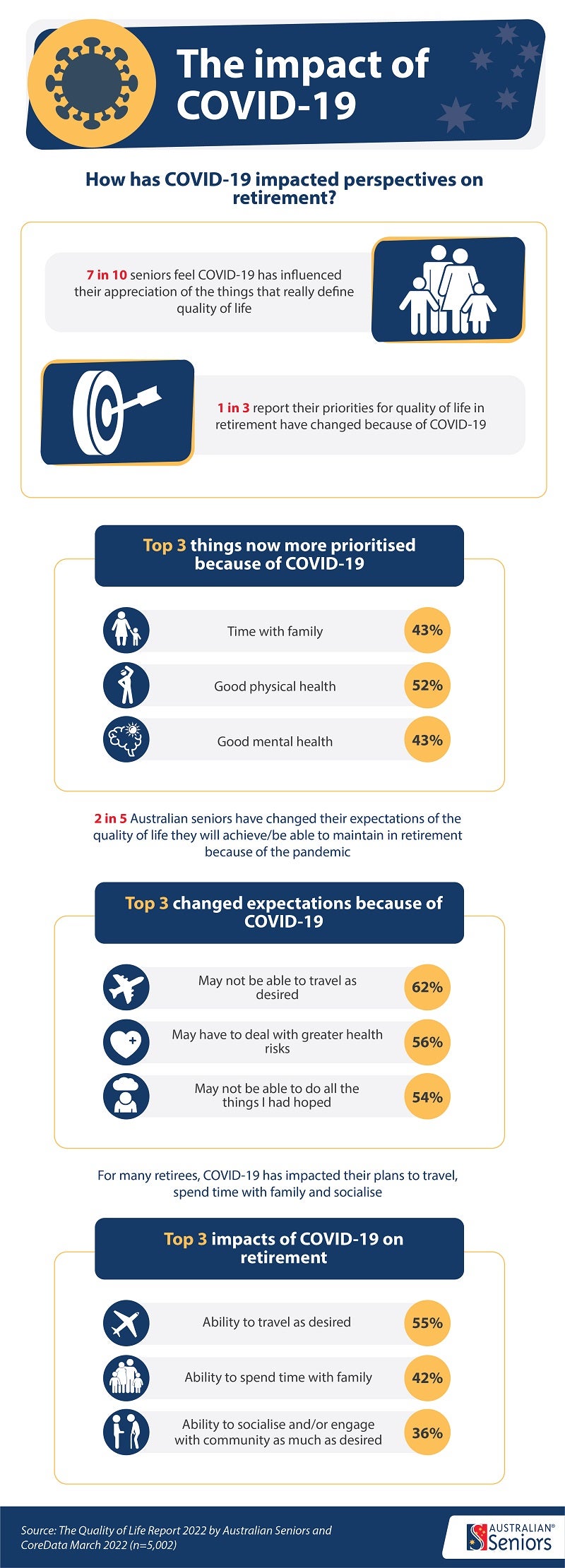

Due to COVID-19, the past two years have brought about more disruption and uncertainty than many of us have experienced in our lifetimes, from being separated from our loved ones to worrying about the rising cost of living, our job security, and our health. For many of us, it’s encouraged us to pause and take stock of what really matters and what we want for our future.

About the Report

The Quality of Life 2022 report forms part of the Australian Seniors Series, which explores the subject matters most important to our senior community. Surveying 5,000 Australians over 50, this in-depth study explores how our community has re-prioritised our lives since the pandemic, and what this means for retirement planning.

With years of wisdom under our belt, recent events have proven just how resilient we can be to change, with many of us seeing it as an opportunity to reconnect with our core values and pursue them in the next chapter of our lives.

Defining Quality of Life in Retirement

In fact, nearly 7 in 10 (69%) of us have been influenced by the pandemic on our appreciation of the things that define quality of life, and our definition of quality of life in retirement has become much more well-rounded, with good physical health (87%), being financially comfortable (85%), good mental health (82%), and living independently for as long as possible (79%) being our top considerations.

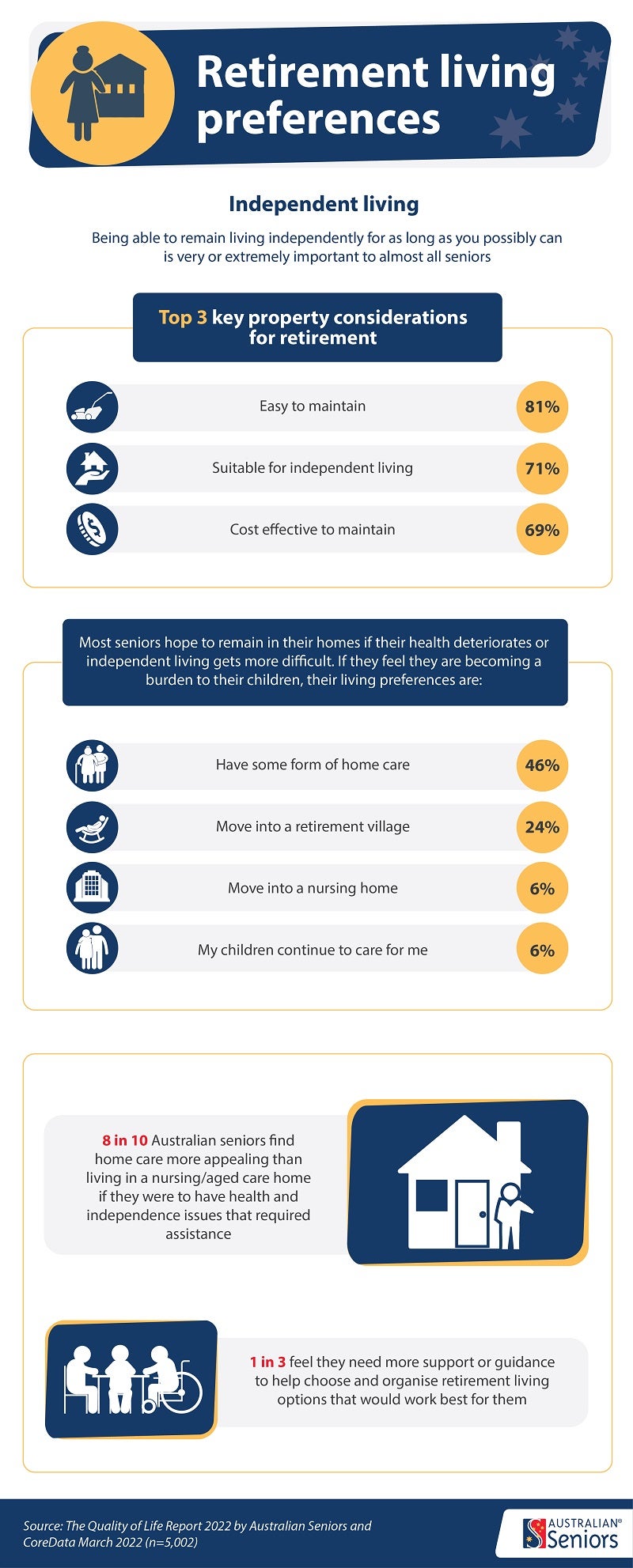

Desire for Independent Retirement Living for a Purpose Driven Life

No matter how old we are, we’ve never lost sight of our independence and the personal fulfilment it can bring. In fact, this is the single most important thing to nearly all (94%) of us when we consider what matters most now and in the future. Losing our independence is also one of our greatest fears (45%) when thinking about our future retirement plans and living in a retirement home.

Maintaining our independence as we look ahead promotes a sense of achievement and creates feelings of self-worth and purpose in our community —something many of us have been searching for since the onset of the pandemic. It’s unsurprising then, that most (82%) of us have a strong preference for continuing to live independently in our homes should we require additional support down the track, as opposed to living in an aged care facility.

The Financial Challenge for Retirees

But opting to continue our next chapter from the comfort of our own homes comes with its own concerns and challenges, such as how we’ll afford our future care needs and what impact this will have on our nearest and dearest.

Recent years have been a sobering realisation of just how fragile our financial situation can be. In fact, around 2 in 5 (41%) of us now expect a future where we’ll have to make do with less money. With nearly two-thirds (63%) of us lacking firm financial plans for our retirement, it makes sense that being able to afford home care is a key deterrent for almost half of us (47%).

The emotional challenge - Addressing Mental Health Issues

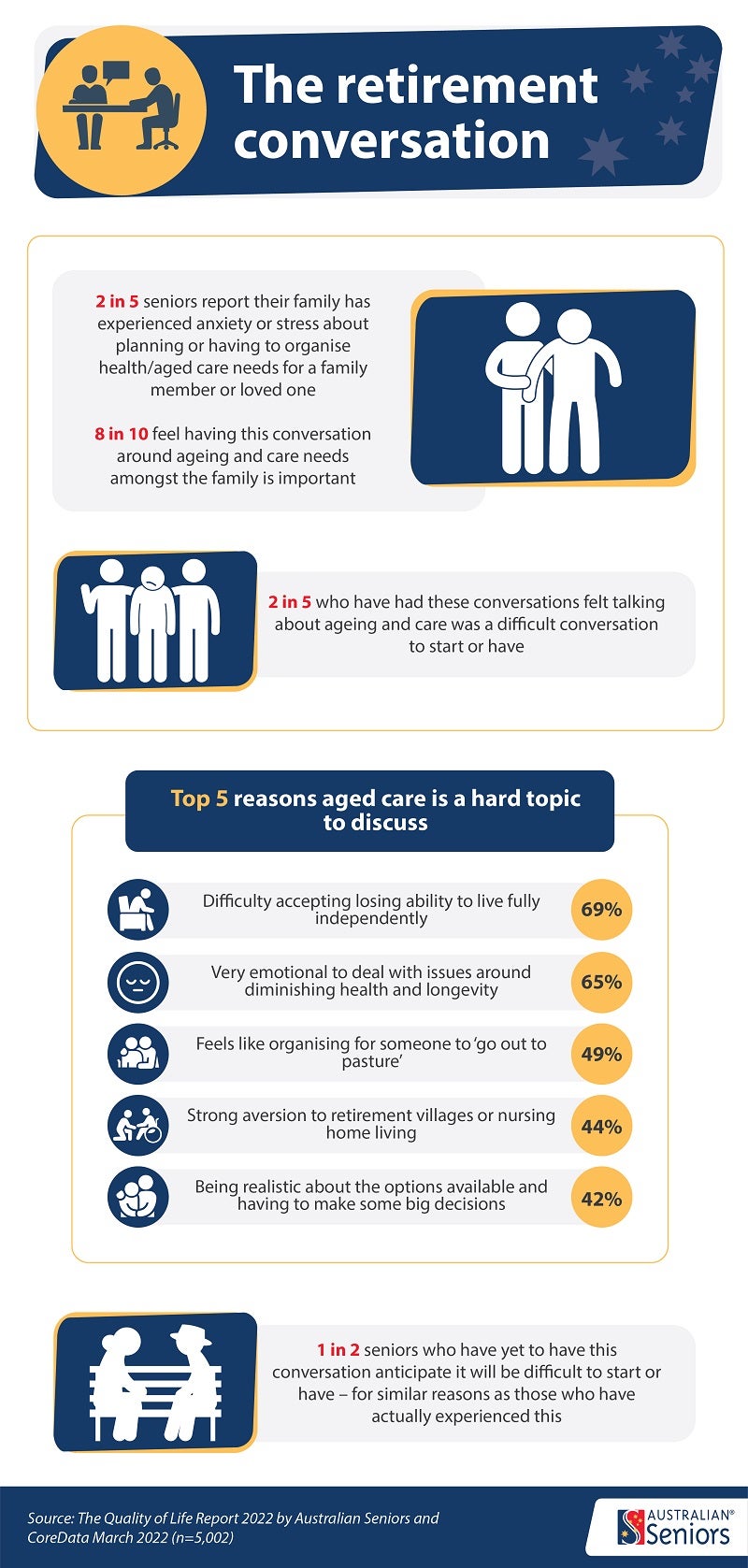

Building on this, recent years have also highlighted the importance of our loved ones, with almost half (42%) of us admitting that not being able to spend time with family was the hardest part of the pandemic. It follows then that living with or nearby family is one of the greatest perceived advantages of home care for more than half (51%) of us.

On the flip side, over 2 in 5 (42%) of us report that the welfare and happiness of our family is one of our greatest concerns looking into the future, and as many as quarter (25%) of us worry about being a burden to our family when considering our retirement and care plans.

Even though the majority (82%) of us agree that having a conversation with our family around ageing and our future care needs is important, a sense of guilt and the emotions involved with diminishing health have proven to be obstacles for almost half of us (47%) who have been putting it off.

Why Planning for Retirement Living is Important

While thinking about the next chapter of our lives can be a confronting topic, it’s important to have a support network to help us navigate this milestone. In fact, as many as 3 in 5 (63%) of us feel we need more support and guidance when it comes to making big decisions about our future living arrangements and aged care needs.

Deputy Director of the Centre for Ageing, Cognition and Wellbeing at Macquarie University, Dr. Carly Johnco, shares some sage advice for those looking to start the conversation with their loved ones. “Planning for retirement and old age can confront us with thoughts about a range of negative scenarios, including how we might need to change our lifestyle in the case of physical health problems, housing, finances and social relationships. It’s very normal to want to avoid situations or topics that make us feel anxious or uncomfortable, so it’s unsurprising that many Australians have delayed their retirement planning or have avoided having conversations about retirement planning with loves ones altogether. However, avoiding retirement planning doesn’t make it easier in the long run, and can result in poorer outcomes when the appropriate plans have not been put in place”.

“When tasks feel overwhelming, it’s often helpful to break them down into smaller steps. Breaking down the conversation around retirement planning into separate topics, whether it be financial, health, social or housing, can be easier than trying to tackle all the possible issues at once. Perhaps you could initially mention to a family member that you would like to set up a future time to discuss retirement and care plans or ask them to help you collect some information about one area of retirement planning to get them started. Having a close friend or family member support you as you consider the information can also help to keep the planning on track and avoid the urge to give up when it gets hard”.

Stay tuned for the next chapter of the Australian Seniors Series – a report for seniors by Australian Seniors.

10 May 2022